The Secret To Building Generational Wealth With Your Job Income Revealed

What the Banks, Credit Card Companies & The Government don't want you to know!

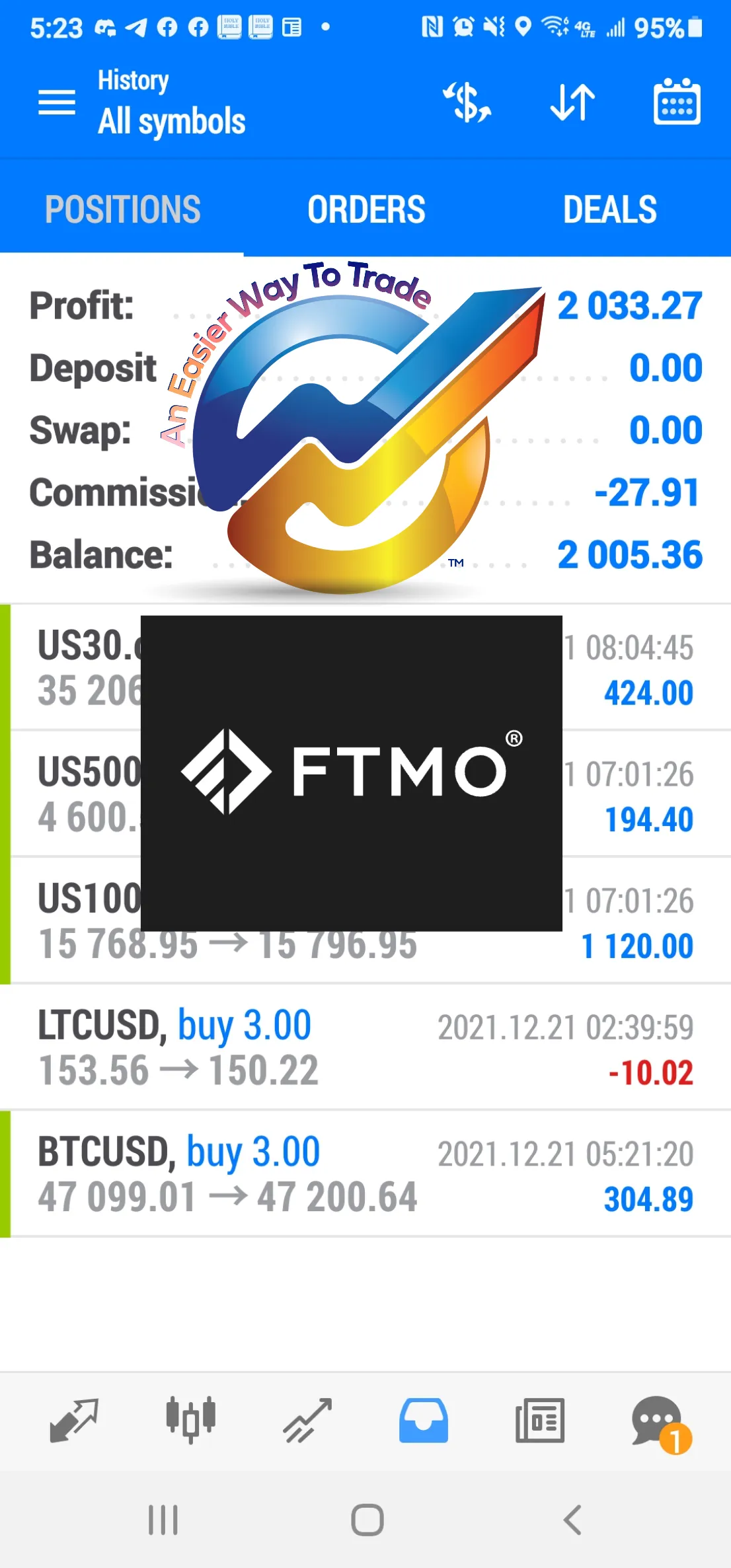

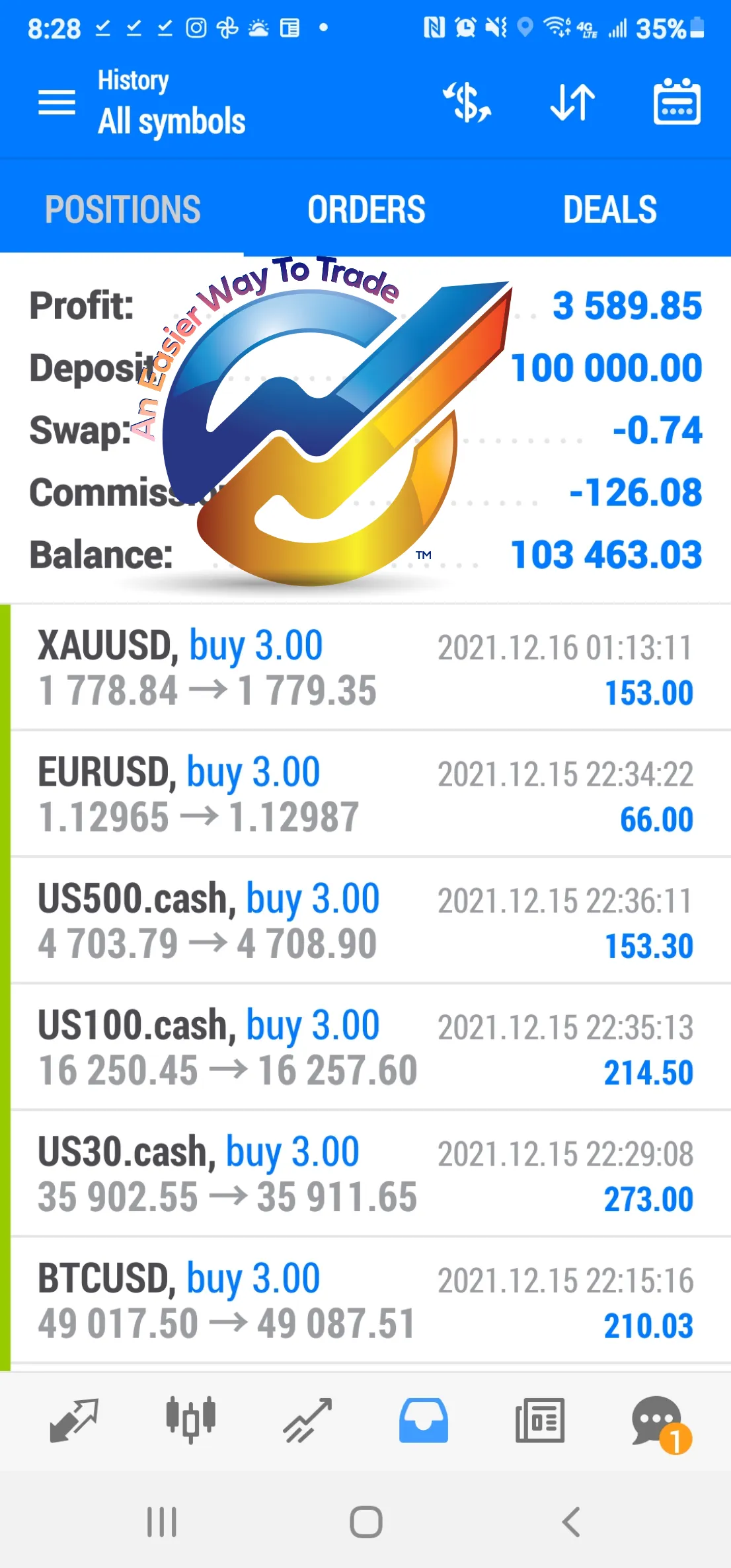

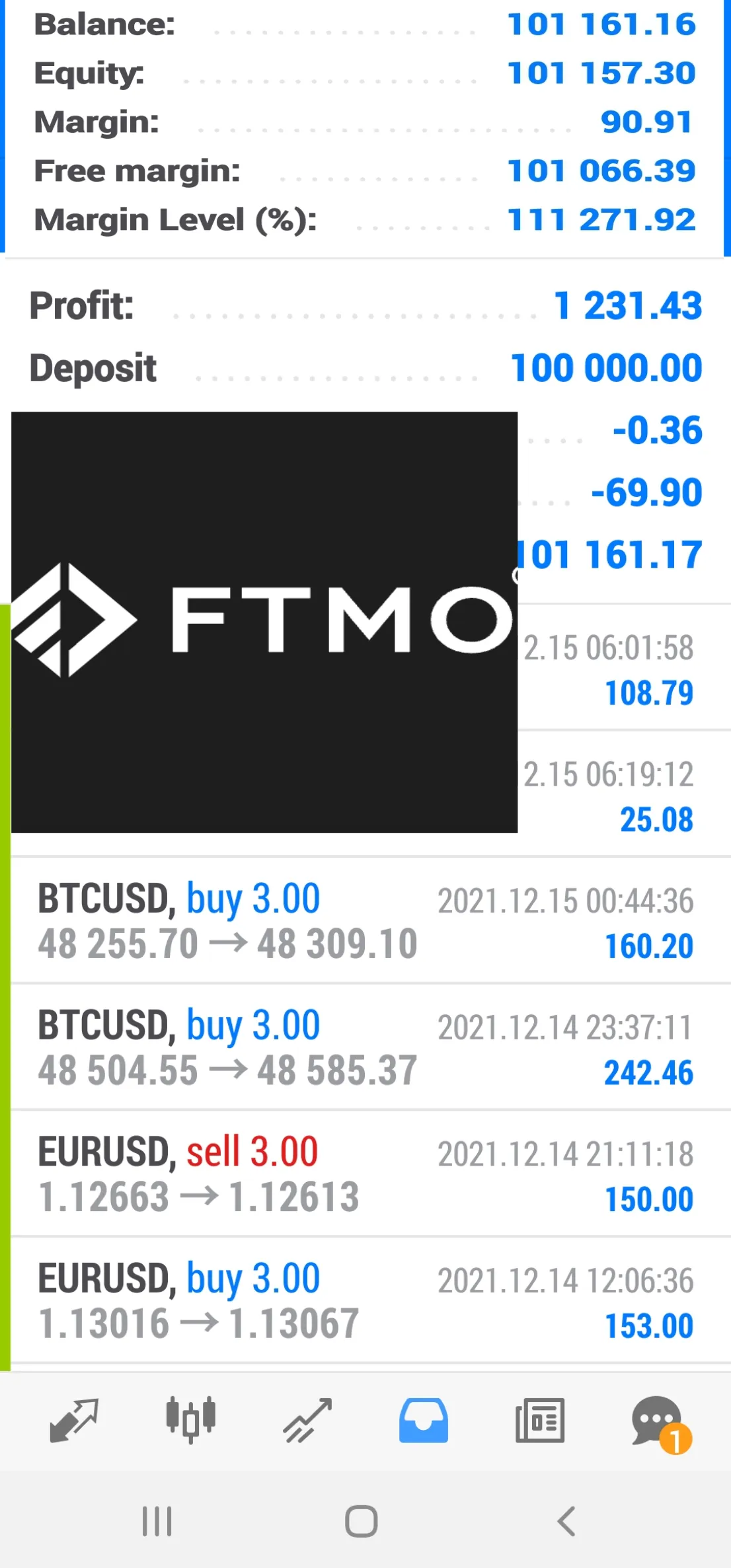

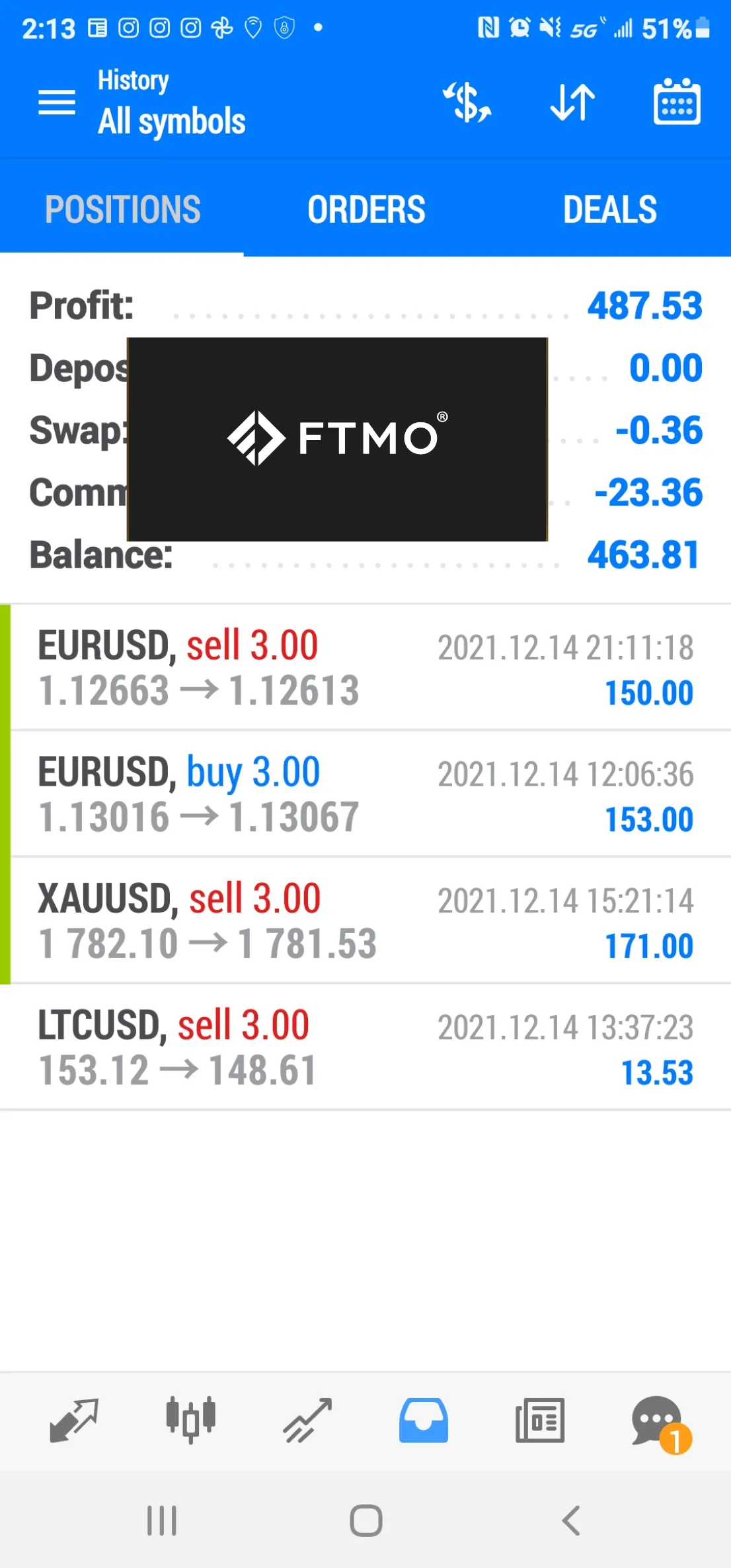

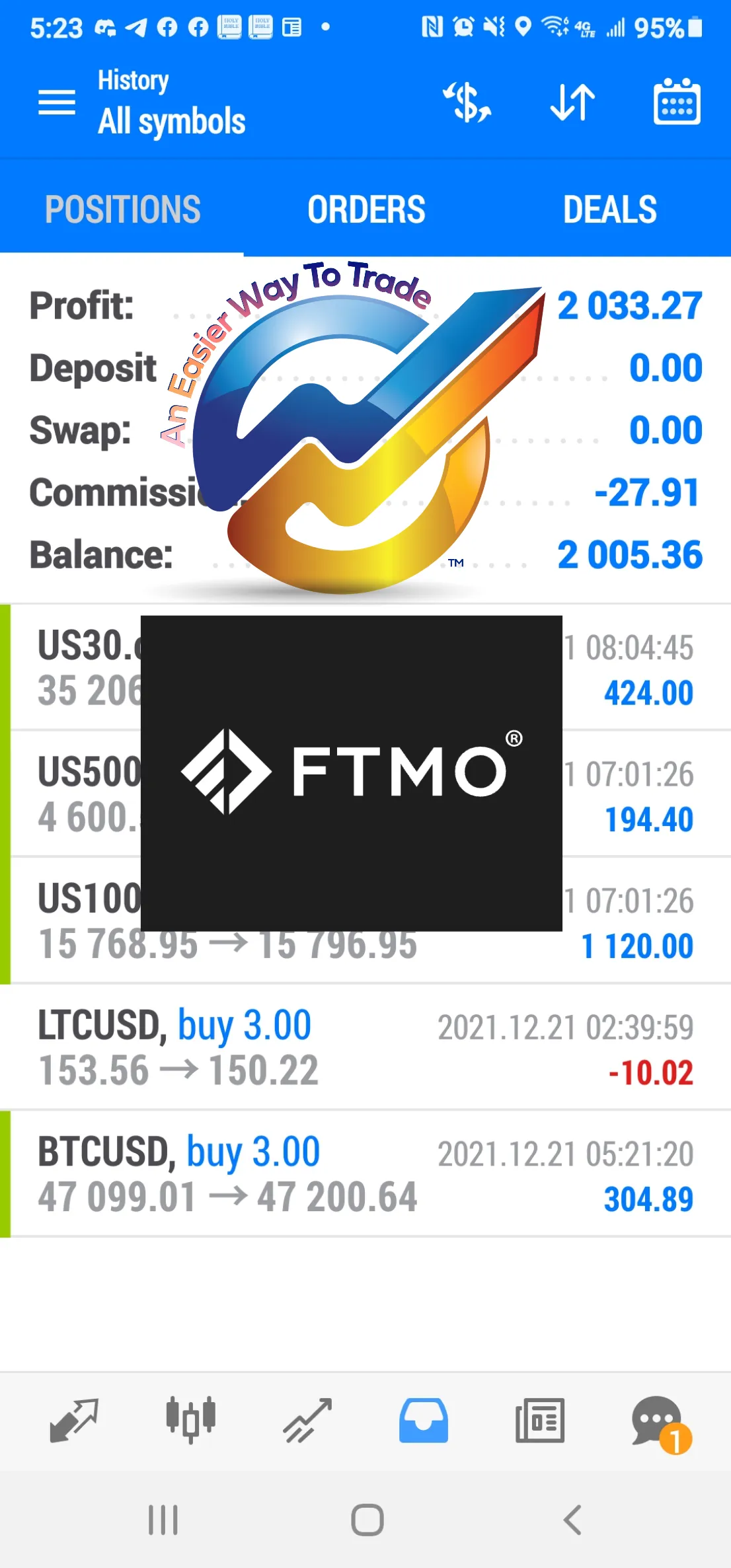

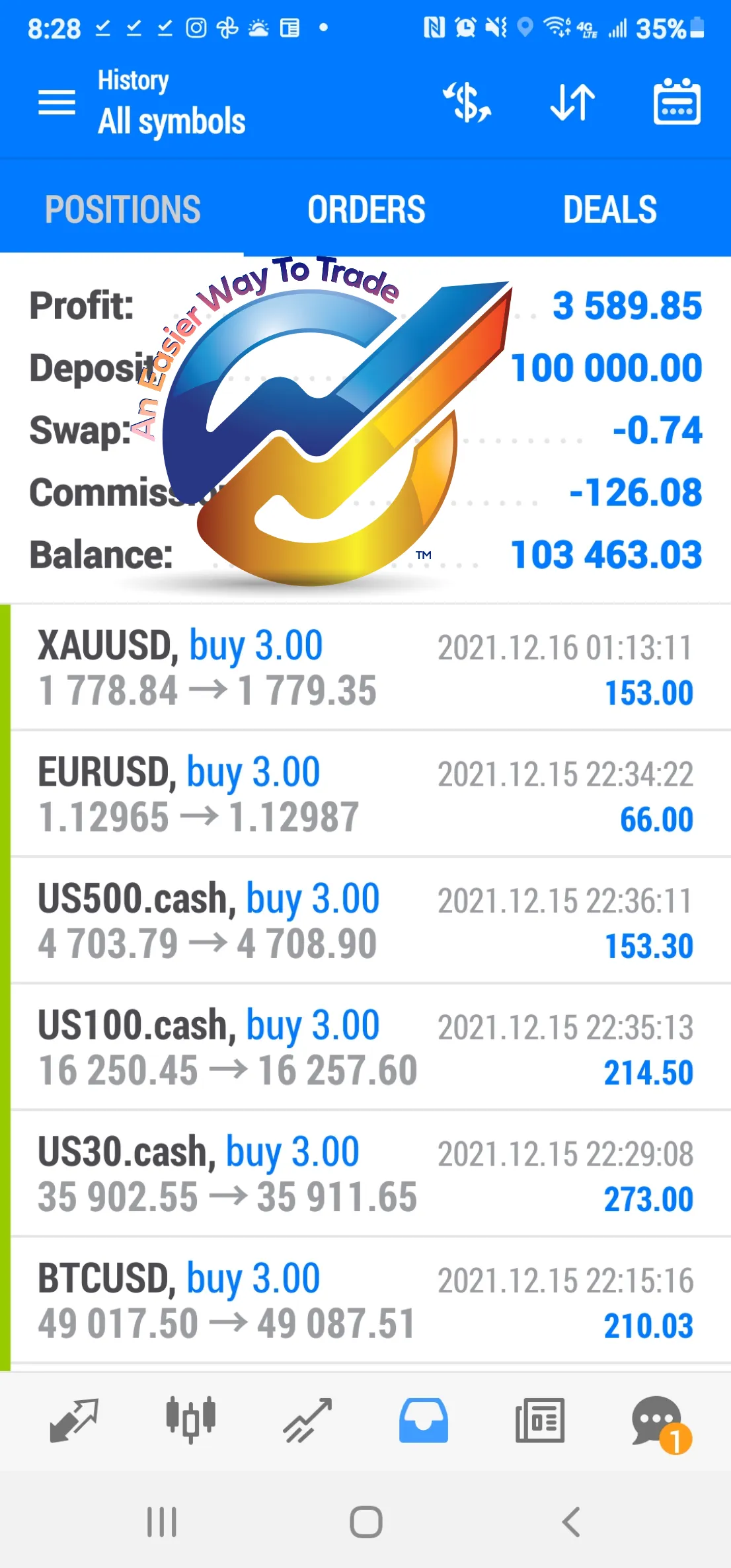

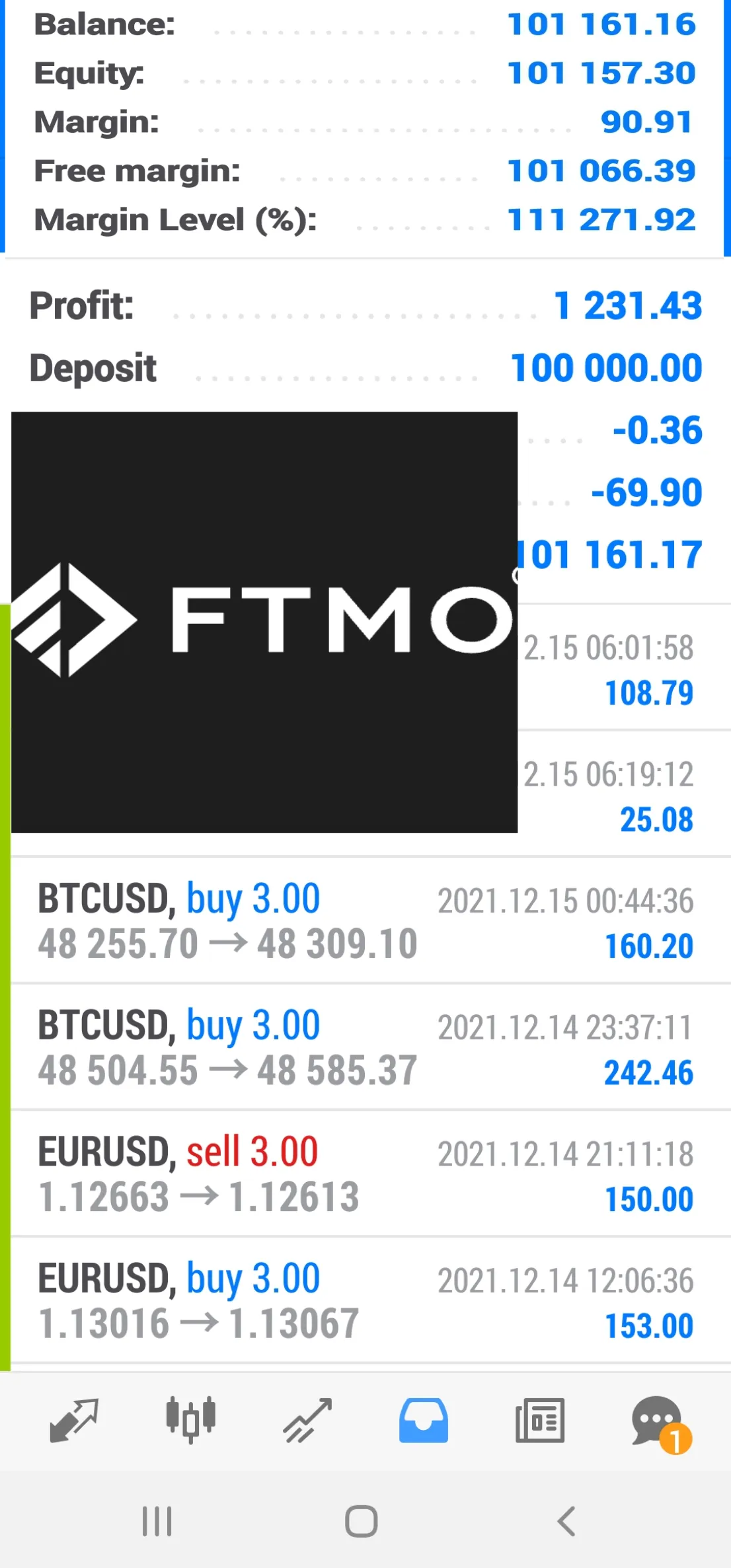

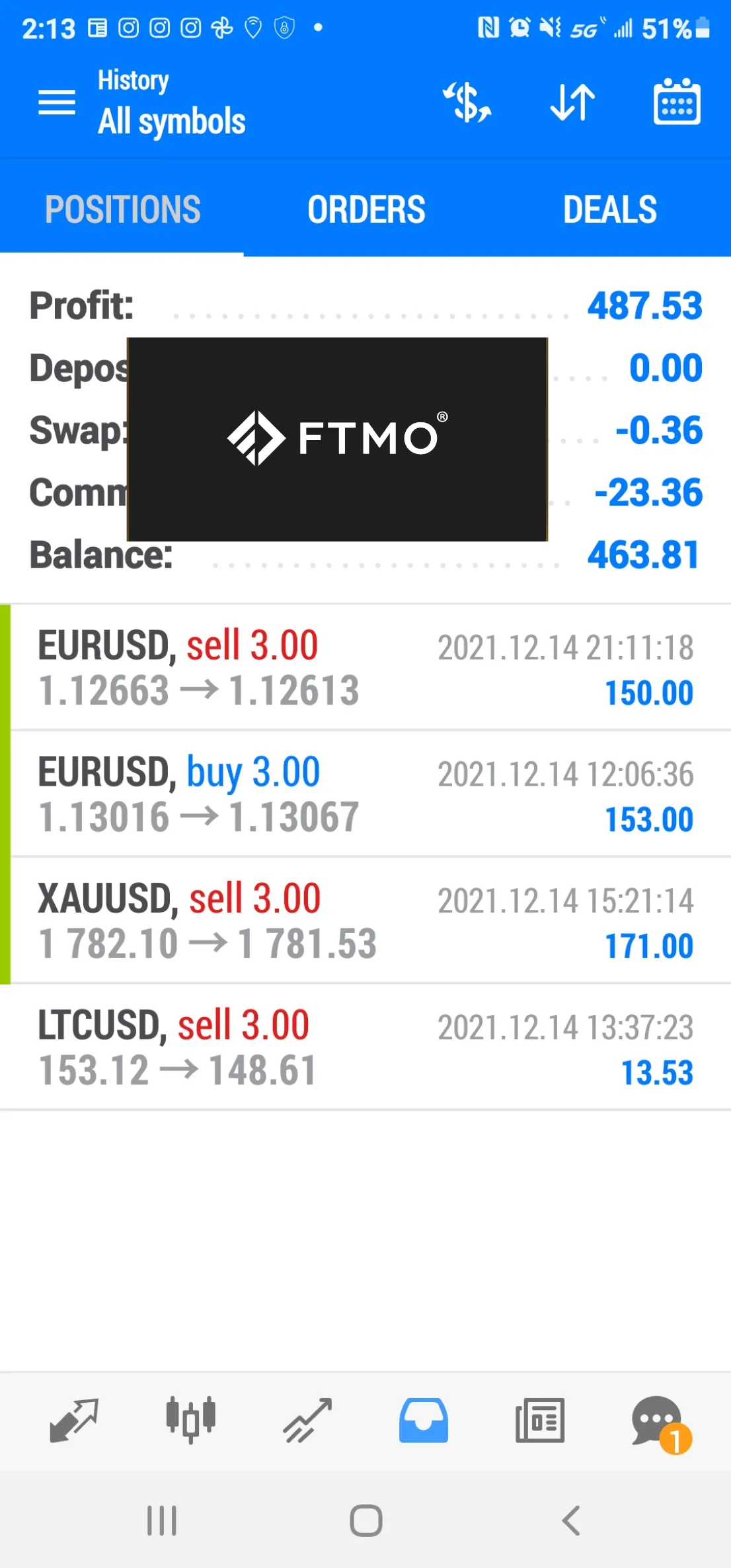

Yes! ...there is "An Easier Way To Trade"!

Starting Jan. 1, 2022-Jan. 30, 2022

Get a FREE 30-day Trial of

Forex Robot Expert Advisor!

Press Play And Turn On Your Sound

Press Play And Turn On Your Sound

Starting Jan. 1, 2022-Jan. 30, 2022

Get a FREE 30-day Trial of

Forex Robot Expert Advisor!

Sign-Up below to

Get Immediate Access!

MEET YOUR COACH

With a custom Kettle program outlining daily steps towards your specific goals, you will never feel out of the loop with your fitness routine again. It's like your own personal fitness coach, now in your pocket!

The Right Place

We design functional fitness programs that you can perform anywhere with minimal equipment. Get your workout in on the go!

The Right Diet

Your dream body is like your dream car. Give it the fuel it needs to perform its best. We'll take out the guesswork with custom meal plans and grocery lists.

The Right Equipment

As you advance through your program, we'll make sure you have access all of the equipment you need to push past plateaus and become your strongest self.

Starting Jan. 1, 2022-Jan. 30, 2022

Get a FREE 30-day Trial of

Forex Robot Expert Advisor!

Starting Jan. 1, 2022-Jan. 30, 2022

Get a FREE 30-day Trial of

Forex Robot Expert Advisor!

:: Disclaimer :: Past profits do not guarantee future results.

Only trade with money that you can afford to lose.

Financial Health Mentor © 2022 All Rights Reserved

Privacy | Site Terms | Disclaimer | Design Credit: BrandMaster